SUPPLY

Inventory

Actual crudes and petroleum products closing inventory for the month of December 2012 was reported at 13,085 thousand barrels (MB) or 44-days supply equivalent; 35 days for crude oil and products in country stocks and 9 days in-transit. This was slightly lower in volume by 0.6 percent from last year’s December level of 13,169 MB. YTD December 2012 average inventory was recorded at 47 days, 38 days in country stock and 9 days in-transit.

The Minimum Inventory Requirement (MIR) is still being enforced given the continuing risks faced by the downstream oil industry sector such as geopolitical instability and supply delivery problems to areas affected by calamities (e.g. typhoon, flood, earthquake, etc.).

Current MIR for refiners is in-country stocks equivalent to 30 days while an equivalent of 15 days stock is required for the bulk marketers and 7 days for the LPG players.

Sometime in the third quarter of 2012, Metro Manila and nearby provinces experienced tightness in the supply of LPG. This was due to the delayed arrival of import shipments of a major LPG player in Luzon because of bad weather condition. The situation was further aggravated when their import vessels were unable to dock and unload the LPG cargo due to rough sea and high water level in their Bataan port. This resulted to long queue of their customers’ LPG tank trucks for loading at their depot, mostly independent LPG refillers. The situation normalized a month later with the Department of Energy closely monitoring the situation and coordinating with other LPG importers to ensure continuous LPG supply in the affected areas.

Crude Oil Imports

Total crude oil imported in 2012 reached 64,941 MB, a drop of 6.7 percent vis-à-vis 2011’s 69,615 MB.

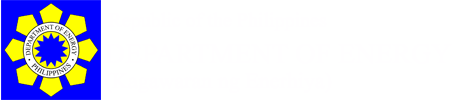

Of these imports, 51,556 MB or 79.4 percent of the crude mix originated from the Middle East. The bulk of the imported crude oil from the Middle East came from Saudi Arabia: 29,784 MB or equivalent to 45.9 percent of the total crude mix (Fig. 1).

On the other hand, a total of 16,754 MB, equivalent to 25.8 percent of the total crude mix, were imported from UAE; 10,253 MB or 15.8 percent came from Russia and 5,018 MB or 7.7 percent was bought from Qatar.

The remaining 4.8 percent (3,131 MB) was imported from the Far East Region such as Malaysia, Brunei, Indonesia and Vietnam and from local production.

Petroleum Product Imports

The country imported a total of 54,754 MB finished petroleum products in 2012, an increase of 18.9 percent from 46,065 MB of 2011.

Meanwhile, on a per product basis, diesel oil posted the biggest growth of 35.7 percent as compared withlast year’s level. Kerosene/avturbo and unleaded gasoline also rose by 20.6 and 10.7 percent, respectively. On the other hand, fuel oil imports and LPG dropped by 18.0 and 0.8 percent, respectively.

The new industry players accounted for majority of the product imports with 54.2 percent of the total imports volume, up by 9.1 percent to 29,678 MB from 2011’s 27,193 MB. The oil majors (Petron, Chevron and Shell) accounted for the remaining 45.8 percent which increased by 32.9 percent from 2011’s 18,872 MB to 25,076 MB.

The local refiners (Petron and Pilipinas Shell) accounted for 26.0 percent of the total product imports, which included blending stocks, as against 74.0 percent by direct importers.

Product import mix comprised mostly of diesel oil at 45.5 percent, unleaded gasoline at 22.6 percent, LPG at 15.2 percent, kerosene/ avturbo at 11.1 percent, fuel oil at 3.4 percent and other products at 2.2 percent share in the total product mix.

Total gasoline import reached 47.7 percent of gasoline demand while diesel oil import was 53.5 percent of diesel demand. LPG import on the other hand, was 66.9 percent of LPG demand. Total product import was 49.3 percent of the total products demand.

The oil majors’ import share in the total demand was 22.6 percent while the other players’ import share was at 26.7 percent. As for the refiners, their import share in the total demand was 12.8 percent, while 36.5 percent was attributed to direct importers.

Crude Run and Refinery Production

The country’s current maximum working crude distillation capacity is 275 thousand barrels per stream day (MBSD).

Total crude processed as of YTD December 2012 fell by 10.0 percent from 69,288 MB of YTD December 2011 to 62,391 MB. The reported refinery capacity utilization also declined by 10.3 percent from 69.1 percent in YTD December 2011 to 62.0 percent this year. This was due to the successive shutdown of the two refineries in the country sometime in the 2nd quarter of 2012 for turnaround/maintenance schedule.

Consequently, local petroleum refinery production output also declined by 10.5 percent from 67,375 MB to 60,293 MB. FY 2012 average refining output was at 164.7 MB per day.

Diesel oil continued to dominate the production mix with a share of 37.5 percent, followed by unleaded gasoline with a 19.9 percent share. Next was fuel oil at 19.0 percent share. Meanwhile, kerosene/ avturbo and LPG got 10.1 and 6.8 percent share, respectively (Fig. 2).

Refinery output of all petroleum products decreased vis-à-vis last year. Fuel oil, kerosene/avturbo and diesel oil decreased by 13.1, 11.1 and 10.2 percent, respectively. LPG refinery output also went down 9.2 percent.

DEMAND

Petroleum Product Demand

The country’s total demand of finished petroleum products in year 2012 was up by 3.9 percent to 110,991 MB from 106,857 MB of year 2011. This can be translated to an average daily requirement of 303.3 MB compared with last year’s level of 292.8 MB.

Compared with last year, unleaded gasoline demand posted an increase of 6.0 percent while diesel oil demand rose by 4.5 percent. Kerosene/avtubo demand also grew by 4.0 percent. On the other hand, demand of LPG and fuel oil dropped by 1.5 and 0.4 percent, respectively.

Product demand mix comprised mostly of diesel oil at 42.0 percent, unleaded gasoline at 23.3 percent, fuel oil at 11.3 percent, LPG at 11.2 percent, kerosene/ avturbo at 11.1 percent and other products at 1.1 percent share in the total product mix (Fig. 2).

Petroleum Product Exports

Total petroleum products exported for the period was down by 30.3 percent from 13,470 MB of 2011 to 9,395 MB. This may be attributed to the shutdown of refineries for turnaround schedule as cited previously.

On a per product basis, exports of all petroleum products dropped vis-à-vis 2011 figures except diesel oil which grew by 43.5 percent. Condensate, the top product exported for the period fell by 12.4 percent. Fuel oil also decreased by 61.9 percent. Exports of naphtha went down by 9.4 percent.

The total export mix comprised of condensate (48.8 percent); naphtha (17.0 percent); fuel oil (14.3 percent); mixed xylene (9.4 percent); toluene (3.5 percent); reformate (1.3 percent); and benzene (1.5 percent), respectively.

The oil refiners accounted for 51.2 percent of the total export mix while the condensate exports of Shell Philippines Exploration B. V. (SPEX) and LPG exports by Liquigaz accounted for the remaining 48.8 percent.

Crude Oil Exports

A total of 1,401 MB crude oil from Galoc (Palawan Light) was exported during the year which fell by 42.7 percent vis-à-vis 2,447 MB of last year due to its low production which resumed only in May 2012 after a 6-month long shutdown.

MARKET SHARE

Total Petroleum Products

The major oil companies (Petron Corp., Chevron Phils. and Pilipinas Shell Petroleum Corp.) got 72.8 percent market share of the total demand while the other industry players which include PTT Philippine Corp. (PTTPC), Total Phils., Seaoil Corp., TWA, Filpride, Phoenix, Liquigaz, Petronas, Prycegas, Micro Dragon, Unioil, Isla LPG Corp., Jetti and Filoil Gas Co., as well as the end users who imported directly part of their requirement captured 27.2 percent of the market (Fig. 3).

Meanwhile, the local refiners (Petron Corp. and Pilipinas Shell) captured 62.9 percent of the total market demand while 37.1 percent was credited to direct importers/distributors.

LPG

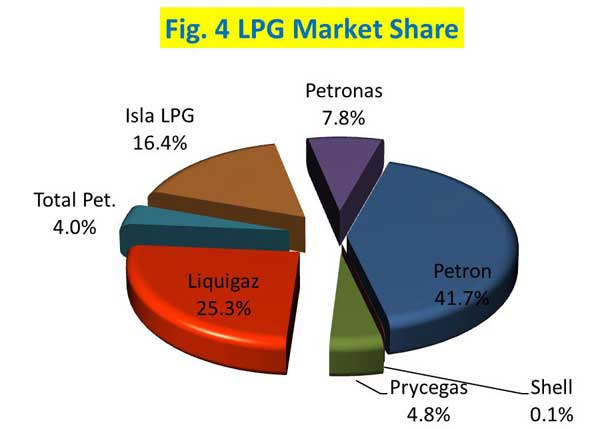

With Pilipinas Shell’s selling its interest in the entire issued share capital of Shell Gas (LPG) Philippines Inc. to Isla LPG Corp. on 27 January 2012, the LPG market share of the oil refiners for 2012 was reduced to 41.8 percent from 56.0 percent of 2011.

The other players on the other hand, with the entry of Isla LPG increased to 58.2 percent from 44.0 percent of 2011.

Among the other LPG players, Liquigaz got the biggest market share with a 25.3 percent share, followed by Isla LPG with a share of 16.4 percent. Next was Petronas with a share of 7.7 percent (Fig. 4).

OIL IMPORT BILL

Full year 2012 total oil import bill amounting to $13,861.2 million was up by 7.9 percent from full year 2011’s $12,846.2 million despite the decrease in crude import volume. This is due to high import costs of both crudes and finished products during the period as compared to year ago level.

Total oil import cost was made up of 53.6 percent crude oil and 46.4 percent finished products.

Import cost of crude oil, amounting to $7,430.9 million at an average CIF cost of $114.426/bbl, was 2.1 percent lower than $7,590.1 million of year 2011 at an average CIF cost of $109.932/bbl.

Meanwhile, total product import cost increased by 22.3 percent to $6,430.2 million at an average CIF cost of $117.438/bbl vis-à-vis 2011’s $5,256.1 million at an average CIF cost of $114.102/bbl.

With the decreased volume of petroleum products and crude oil exported for the period, the country’s petroleum export earnings fell by 30.3 percent from $1,770.6 million of 2011 to $1,233.9 million this year.

Overall, the country’s 2012 net oil import bill amounting to $12,627.3 million was up by 14.0 percent from 2011 level of $11,075.7 million.