SUPPLY

Inventory

Given the uncertainties on supply due to the lingering conditions in the Middle East and African Nations (MENA), the government, through the Department of Energy (DOE), continues to find ways to address vulnerability to supply disruptions and higher oil prices.

One of these is the continuous enforcement of the Minimum Inventory Requirement (MIR). Under this scheme, the local oil refiners are required to maintain at least 30 days supply equivalent, the bulk suppliers at 15 days supply equivalent and the LPG importers at 7days supply equivalent of in-country stocks.

Based on monitored weekly reports, the oil companies normally maintained more than the required minimum level of stocks.

Actual total country crudes and petroleum products inventory as of end December 2011 was recorded at 13.2 million barrels (MMB) or 42-days supply equivalent, 34 days for crude oil and products in stocks and 9 days in-transit, respectively. This was lower by 4.7 percent from last year’s end-December level of 13.8 MMB. YTD December 2011 average inventory was reported at 50 days, 39 days in stock and 11 days in-transit.

Crude Oil Imports

Various type of crude oil imported for the year totaled 69.6 MMB. This reflected an increase of 4.3 percent vis-à-vis last year’s 66.8 MMB.

Crude oil imported from the Middle East Region represented 76.1 percent (52.9 MMB) of the total country’s crude mix wherein 30.8 MMB of which was sourced from Saudi Arabia, the top exporter of crude oil into the country.

Meanwhile, crude imports sourced from Russia, which was 20.6 percent of the total crude mix, almost tripled to 14.3 MMB from 5.2 MMB of 2010, reducing the country’s dependency on Middle East crudes by about 2.4 percent.

The remaining 3.4 percent was imported from the Far East Region such as Malaysia, Philippines and Singapore totaling 2.3 MMB

Petroleum Product Imports

FY 2011 import volume of finished petroleum products dropped by 15.6 percent from 54.6 MMB of 2010 to 46.1 MMB, which was partly due to increased refinery production output during the period.

Imports of fuel oil recorded the biggest drop of 59.6 percent vis-à-vis last year. Diesel oil, unleaded gasoline and LPG also fell by 17.9, 11.3 and 4.2 percentages, respectively. On the other hand, kerosene/avturbo imports rose by 32.5 percent.

The other industry players’ import volume accounted for 59.0 percent of the total imports, down by 2.4 percent from last year’s 27.8 MMB to 27.2 MMB. The oil majors (Petron, Chevron and Shell) accounted for the remaining 41.0 percent with a decrease of 29.5 percent from last year’s level of 26.8 MMB to 18.9 MMB.

Meanwhile, the local refiners (Petron and Pilipinas Shell) accounted for 18.5 percent of the total product imports while 81.5 percent was attributed to direct importers.

Product import mix were comprised mostly of diesel oil at 39.9 percent, unleaded gasoline at 24.2 percent, LPG at 18.2 percent, kerosene/ avturbo at 11.0 percent, fuel oil at 5.0 percent, and other products at 1.8 percent.

Total gasoline import reached 45.7 percent of gasoline demand while diesel oil import was 41.2 percent of diesel demand. LPG import on the other hand, was 66.5 percent of LPG demand. Total product import was 43.1 percent of the total products demand.

The oil majors’ import share in the total demand was 17.7 percent while the other players’ import share was at 26.4 percent. As for the refiners, their import share in the total demand was 8.0 percent, while 35.1 percent was attributed to direct importers.

Crude Run and Refinery Production

The country’s current maximum working crude distillation capacity is 275 thousand barrels per stream day (MBSD).

Total crude processed grew by 5.1 percent from 65.9 MMB to 69.3 MMB during the period. Vis-à-vis last year, the reported refinery capacity utilization also improved from 65.0 percent to 69.1 percent this year.

Consequently, local petroleum refinery production output also rose by 5.9 percent from last year’s 63.6 MMB to 67.4 MMB. YTD December 2011 average refining output was at 184.6 MB per day.

Diesel oil continued to dominate the production mix with a share of 37.4 percent, followed by fuel oil with a 19.6 percent share. Next was unleaded gasoline at 19.0 percent share. Meanwhile, kerosene/ avturbo and LPG got 10.2 and 6.7 percent share, respectively (Fig. 2).

All petroleum products posted increases vis-à-vis refinery output of 2010 except kerosene/avturbo which recorded a decrease of 4.5 percent. Unleaded gasoline refinery output posted the largest increase of 12.2 percent, followed by diesel oil with a 9.8 percent growth. Likewise, LPG and fuel oil refinery output also rose by 6.8 and 2.3 percent, respectively.

DEMAND

Petroleum Product Demand

Petroleum products demand for the period fell by 4.4 percent to 106.9 MMB from 111.8 MMB of 2010. This can be translated to an average daily requirement of 292.8 MB compared with 2010’s 306.3 MB.

Compared with last year’s level, demand of fuel oil recorded the largest decrease of 29.8 percent in the total demand and almost 33.0 percent drop in the industrial trade demand. The decline can be attributed to the shutdown of the Manila-Batangas Black Oil Pipeline in the last quarter of 2010, resulting difficulty in transporting black product to industrial trade clients. Demand of diesel oil and unleaded gasoline was also down by 1.2 and 0.9 percentages, respectively. On the other hand, demand of kerosene/avturbo and LPG rose by 10.1 and 0.6 percentage, respectively.

Diesel oil grabbed a hefty 41.7 share in the demand mix while unleaded gasoline captured 22.8 shares. Meanwhile, LPG and fuel oil both got 11.8 percent share, respectively. Kerosene/avturbo contributed 11.1 percent share in the total demand mix while the other products a mere 0.8 percent (Fig. 2).

Petroleum Crude Oil/Product Exports

Total petroleum products exported for the period grew by 12.0 percent from 12.3 MMB of 2010 to 13.5 MMB.

Vis-à-vis 2010 figures, fuel oil exports recorded the largest growth of 121.9 percent probably due to its lower domestic demand. Condensate export also rose by 6.8 percent. On the other hand, export of propylene, naphtha and toluene declined by 35.2 20.3 and 19.9 percentages, respectively. Diesel oil (258 MB), kerosene (50 MB) and LPG (66 MB) were also exported this year.

The total export mix comprised of condensate (38.9 percent); fuel oil (26.1 percent); naphtha (13.1 percent); mixed xylene (6.7 percent); propylene (5.2 percent); toluene (3.7 percent); reformate (2.0 percent); diesel oil (1.9 percent); and benzene (1.6 percent), respectively.

The oil refiners accounted for 61.0 percent of the total export mix while the condensate exports of Shell Philippines Exploration B. V. (SPEX) accounted for the remaining 39.0 percent.

Meanwhile, a total of 2,447 MB crude oil (Palawan Light) at an average FOB cost of $110.209/bbl was exported to various countries during the period.

MARKET SHARE

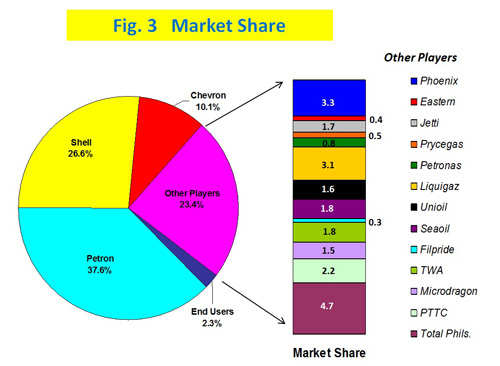

Total Petroleum Products

The major oil companies (Petron Corp., Chevron Phils. and Pilipinas Shell Petroleum Corp.) got 74.3 percent market share of the total demand while the other industry players which include PTT Philippine Corp. (PTTPC), Total Phils., Seaoil Corp., TWA, Filpride, Phoenix, Liquigaz, Petronas, Prycegas, Micro Dragon, Unioil, Eastern Petroleum and Jetti as well as the end users who directly imported part of their requirement captured 25.7 percent of the market (Fig.3).

Local refiners (Petron Corp. and Pilipinas Shell) captured 64.2 percent of the total market demand, while 35.8 percent was credited to direct importers/distributors.

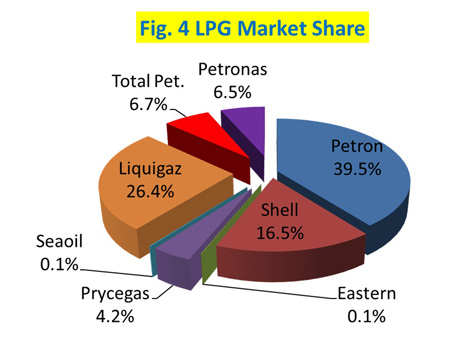

LPG

In the LPG industry, Petron Corp. and Pilipinas Shell Petroleum Corporation’s market shares totaled 56.0 percent while the other players obtained 44.0 percent.

Among the other LPG players, Liquigaz got the biggest market share with a 26.4 percent share, followed by Total Philippines with a share of 6.7 percent (Fig. 4).

OIL IMPORT BILL

Full year 2011 total oil import bill amounting to $12.8 billion grew by 28.8 percent from 2010’s $9.98 million despite the decrease in petroleum products import volume. The reason may be due to high import costs of both crudes and finished products during the period as compared to year ago level.

Total oil import cost was made up of 59.1 percent crude oil and 40.9 percent finished products.

Import cost of crude oil amounted to $7.6 billion at an average CIF cost of $109.030/bbl, was 42.5 percent higher from 2010’s $5.3 billion at an average CIF cost of $79.766/bbl.

Meanwhile, total product import cost increased by 13.0 percent to $5.3 billion at an average CIF cost of $114.102/bbl vis-à-vis last year’s $4.6 billion at an average CIF cost of $85.146/bbl.

The country’s petroleum export earnings rose by 45.0 percent from $1.2 billion last year to $1.8 billion.

Overall, the country’s net oil import bill for the period amounting to $11.1 billion was up by 26.5 percent from last year’s $8.8 billion.