OIL SUPPLY/DEMAND REPORT 2009

SUPPLY

Inventory

Actual crudes and petroleum products inventory as of end December 2009 was recorded at 11.6 million barrels (MMB) or 42-days supply equivalent (40 days for crude oil and products in stock and 2 days for crude in-transit to the country). This is 18.4 percent lower than last year’s end-December level 14.2 MMB. On the other hand, 2009 average inventory was reported at 15.1 MMB, 44 days in stock and 9 days in-transit.

Meanwhile, sometime during the last quarter of 2009, with the extensive damage brought by Typhoons Ondoy and Pepeng in Luzon, President Gloria Macapagal-Arroyo issued Executive Order No. 839 which ordered the oil companies to retain the level of the retail price of petroleum products prevailing on October 15, 2009. With its Implementing Guidelines (Department Circular No. DC 2009-10-0013), the DOE was tasked to monitor the daily inventory of specific petroleum products, namely gasoline, diesel, biodiesel, kerosene and LPG in Luzon areas. As such, the oil companies and LPG industry players were required to report their daily stocks of the mentioned products in order to monitor and assess the status of total supply in Luzon.

The E.O. has been effective until the issuance of E.O. 845 on 15 November. This, however, directed the oil players in Luzon to implement a more targeted and focused assistance program in the identified calamity areas.

Crude Oil Imports

Year 2009 crude imports dropped to 50.6 MMB, 27.3 percent lower than 2008’s 69.5 MMB. This was due to the maintenance and emergency shutdowns of the country’s local refineries sometime during the period, hence the lower volume of crude imported.

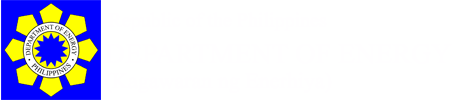

Crudes imported from the Middle East totaled 42.2 MMB, representing 83.5% of the total crude mix while crudes from the Far East region (5.2 MMB) such as Malaysia, Philippines, Indonesia and Singapore supplied 10.2% of the total crude mix (Fig. 1)

Saudi Arabia supplied more than forty percent (44.7%) of the country’s crude requirements. Next was UAE with a 20.1 percent share, followed by Qatar with a 16.6 percent share. Meanwhile, a total of 2.8 MMB crude, representing 5.5 percent of the total crude mix, was imported from Russia.

Petroleum Product Imports

Imports of finished petroleum products in 2009 grew by 19.7 percent from 48.3 MMB of year 2008 to 57.8 MMB. This was due to low refinery production output during the period. As a consequence, the local refiners, as well as the other players, increased their imports to augment their requirements.

Diesel oil imports swelled by more than thirty percent (31.9%) compared to year ago level. Imports of unleaded gasoline and LPG also grew by 21.5 and 19.3 percent, respectively. However, fuel oil imports declined by 22.1 percent.

The oil majors (Petron, Chevron and Shell) accounted for 61.1 percent of the total import volume with an increase of 16.6 percent from last year’s level of 30.3 MMB to 35.3 MMB. The growth was due to increased volume of product imports of the local refiners due to the total shutdown of their refineries for maintenance sometime during the period. As for other industry players’ import volume which accounted for the remaining 38.9 percent, an increase of 25.1 percent was also recorded from last year’s 18.0 MMB to 22.5 MMB this year.

Meanwhile, the local refiners (Petron and Pilipinas Shell) accounted for 35.3 percent of the total product imports while 64.7 percent was attributed to direct importers.

Product import mix is comprised mostly of diesel oil at 41.2 percent, unleaded gasoline at 22.7 percent, LPG at 16.6 percent, fuel oil at 9.6 percent, kerosene/avturbo at 7.7 percent and other products at 2.2 percent.

Total gasoline import reached 55.1 percent of gasoline demand while diesel oil import was 54.6 percent of diesel demand. LPG import on the other hand, was 76.6 percent of LPG demand. Total product import was 53.9 percent of the total products demand.

The oil majors’ import share in the total demand was 32.9 percent while the other players’ import share was at 21.0 percent. As for the refiners, their import share in the total demand was at 19.0 percent, while 34.9 percent was attributed to direct importers.

Moreover, a total of 404 thousand barrels (MB) ethanol was imported for fuel use during the period. Republic Act No. 9367 of 2007 mandated the use of at least 5% bioethanol blend for gasoline by 2010. Philippine National Standards’ PNS/DOE QS 008:2009 for E-Gasoline specified a 9-10% ethanol content as the existing standard for fuel.

Crude Run and Refinery Production

The country’s current maximum working crude distillation capacity is 281 thousand barrels per stream day (MBSD).

Total crude oil processed for the period dropped by 20.0 percent vis-à-vis 2008 level of 67.2 MMB to 53.7 MMB. The decrease in volume was attributed to consecutive maintenance shutdowns of the refineries of Petron and Pilipinas Shell sometime during the period. This resulted to a low refinery capacity utilization of 52.4 percent from 2008’s 64.6 percent.

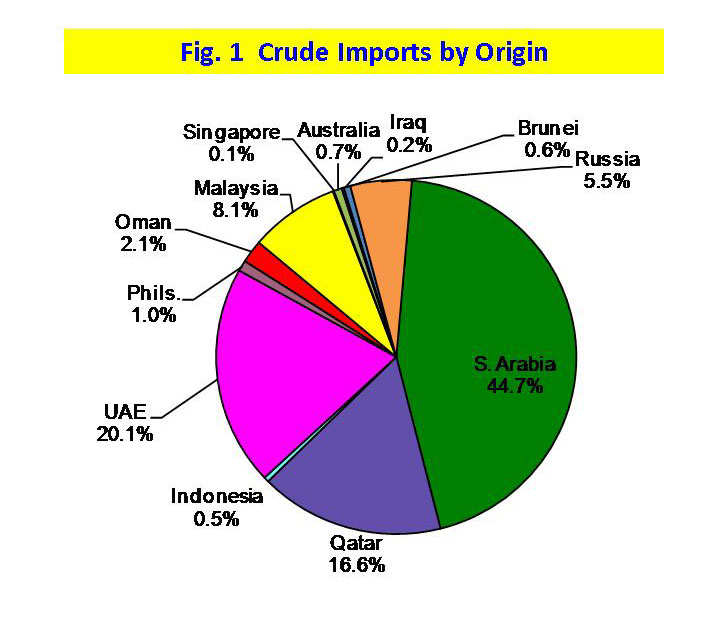

Consequently, local petroleum refinery production output also fell by 20.4 percent from last year’s 64.9 MMB to 51.6 MMB. Full year 2009 average refining output was at 141.5 MB per day.

Diesel oil and fuel oil continued to dominate the production mix with shares of 34.0 and 20.9 percent, respectively. This was followed by unleaded gasoline at 20.3 percent, kerosene/avturbo at 12.1 percent, LPG at 6.4 percent and other products also at 6.4 percent (Fig. 2).

All petroleum products posted increases vis-à-vis refinery output of 2009 level. Diesel oil refinery output posted the largest increase of 30.9 percent, followed by LPG oil with a 28.1 percent growth. Likewise, fuel oil, kerosene/avturbo and unleaded gasoline refinery output also rose by 19.7, 15.1 and 8.9 percent, respectively.

DEMAND

Petroleum Product Demand

The country’s total demand of petroleum products for the period registered an increase of 4.2 percent from 107,299 MB of 2009 to 111,809 MB. This can be translated to an average daily requirement of 306.3 MB compared with the 2009’s 294.0 MB.

Compared with 2009’s demand, fuel oil recorded the largest increase of 13.4 percent, followed by unleaded gasoline with a 3.5 percent growth. Further, with the full implementation of the bioethanol program, demand for E10 gasoline grew by more than a hundred percent (129%). On the other hand, demand for LPG slightly dropped by 0.1 percent.

Diesel oil grabbed a hefty 40.3 share in the demand mix while unleaded gasoline captured 22.0 shares. Fuel oil and LPG trailed along with a 16.0 and 11.2 share, respectively. Kerosene/avturbo contributed 9.6 percent share in the total demand mix while the other products a mere 0.8 percent (Fig. 3).

Petroleum Product Exports

Total petroleum products exported for the period increased by 7.0 percent from 10,779 MB of 2009 to 11,529 MB.

On a per product basis, condensate, the top exported product in the country, fell by 15.9 percent vis-à-vis last year, same with fuel oil which dropped by 10.4 percent. On the other hand, export of naphtha grew by more than a hundred percent (111.7%). Exports of mixed xylene, benzene, toluene, and propylene also posted increases compared with last year’s level.

The total export mix comprised of condensate (39.9 percent); naphtha (18.7 percent); fuel oil (13.7 percent); propylene (9.4 percent); mixed xylene (7.8 percent); toluene/benzene (7.0 percent; reformate (1.7 percent); and other products (1.7 percent), respectively.

The oil majors accounted for 60.1 percent of the total export mix while the condensate exports of Shell Philippines Exploration B. V. (SPEX) accounted for the remaining 39.9 percent.

Meanwhile, a total of 2,612 MB crude oil (Palawan Light) was exported to various countries during the period, an increase of 36.6 percent from last year’s 1,912 MB.

MARKET SHARE

Total Petroleum Products

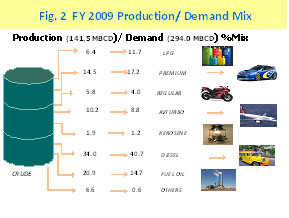

The major oil companies (Petron Corp., Chevron Phils. and Pilipinas Shell Petroleum Corp.) got 77.2 percent market share of the total demand, a slight decrease of 1.6 percent from 78.8 percent of 2009.

On the other hand, market share of the other industry players which include PTT Philippine Corp. (PTTPC), Total Phils., Cross Country, Seaoil Corp., TWA, Filpride, Phoenix, Liquigaz, Petronas, Prycegas, Micro Dragon, Ixion Corp. and Jetti as well as the end users who directly imported part of their requirement captured 22.8 percent of the market (Fig. 3).

Local refiners (Petron Corp. and Pilipinas Shell) captured 65.3 percent of the total market demand, while 34.7 percent was credited to direct importers/distributors.

LPG

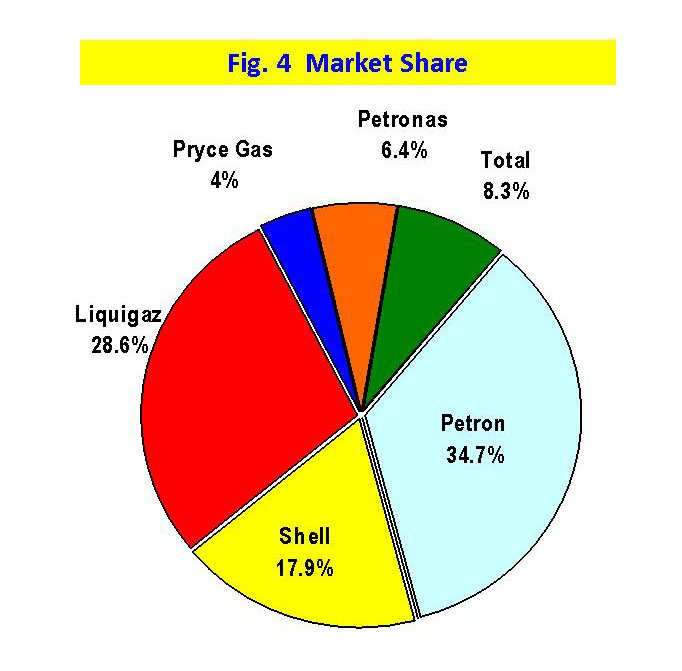

In the LPG industry, Petron Corp. and Pilipinas Shell Petroleum Corporation’s market shares totaled 51.3 percent while the other players obtained 48.7 percent. Among the other LPG players, Liquigaz got the biggest market share with a 30.3 percent share, followed by Total Petroleum with a share of 7.5 percent (Fig. 4).

OIL IMPORT BILL

Year 2010 total oil import bill amounting to $9.9 billion grew by forty percent compared 2009’s 7.1 billion. This was because of the increased volume of crudes and high import costs of both crudes and finished products during the period as compared to year ago level.

Total oil import cost was made up of 53.8 percent crude oil and 46.2 percent finished products.

Import cost of crude oil amounted to $5.4 billion at an average CIF cost of $79.686/bbl, more than fifty percent higher (59.4%) from 2009’s $3.4 billion at an average CIF cost of $64.741/bbl.

Meanwhile, year 2010 total product import cost increased by 22.8 percent to $4.6 billion at an average CIF cost of $84.946/bbl vis-à-vis last year’s $3.7 billion at an average CIF cost of $80.318/bbl.

The country’s petroleum export earnings rose by 48.4 percent from $0.8 billion last year to $1.2 billion.

Overall, the country’s net oil import bill for the period amounting to $8.8 billion was up by 39.0 percent from last year’s $6.3 billion.